இந்தியாவில் இரு சக்கர வாகனங்கள் மிகவும் பொதுவான போக்குவரத்து முறைகளில் ஒன்றாக இருப்பதால், தினசரி பயணத்துடன் தொடர்புடைய அபாயங்களும் சமமாக அதிகமாக உள்ளன. நெரிசலான நகர சாலைகள் முதல் கணிக்க முடியாத போக்குவரத்து நிலைமைகள் வரை, எச்சரிக்கை இல்லாமல் விபத்துக்கள் நிகழலாம்.

With two-wheelers being one of the most common modes of transport in India, the risks associated with daily commuting are equally high. From congested city roads to unpredictable traffic conditions, accidents can happen without warning.

While safe riding practices are essential, financial protection is equally important. This is where third-party insurance for two-wheelers plays a crucial role.

Designed to meet legal requirements at an affordable cost, this policy offers essential protection against liabilities arising from accidents involving another person or property. Let’s explore what third-party bike insurance is and everything it entails.

What is Third-Party Bike Insurance?

Third-party bike insurance is a basic form of bike insurance that provides financial protection against legal liabilities caused to a third party due to an accident involving the insured bike. This can include bodily injury, death, or damage to third-party property.

Unlike comprehensive policies, third-party insurance for bikes does not cover damage to the insured vehicle itself. Its primary purpose is to safeguard the bike owner from financial and legal consequences arising from third-party claims.

The coverage and premium rates are regulated by the Insurance Regulatory and Development Authority of India (IRDAI), ensuring standardisation across insurers.

Is Third-Party Bike Insurance Mandatory in India?

Yes, third-party bike insurance is mandatory in India under the Motor Vehicles Act, 1988. Every bike owner must have at least a valid third-party policy to legally ride on public roads. Failure to comply can result in penalties such as hefty fines or imprisonment.

Additionally, riding without valid two-wheeler insurance can expose the rider to severe financial risks in case of an accident, making it an unavoidable and essential investment.

What Does Third-Party Bike Insurance Cover?

The scope of coverage under third-party insurance for bikes is limited but crucial. It typically includes:

● Third-party Bodily Injury or Death: Compensation for medical expenses, disability, or loss of life of a third party involved in an accident

● Third-party Property Damage: Coverage for damage caused to another person’s vehicle or property, subject to limits defined by IRDAI

● Legal Liabilities: Legal costs arising from court proceedings related to third-party claims

Many riders buy third-party insurance online for two-wheelers due to its simplicity and quick issuance, especially when the goal is legal compliance.

What is Not Covered Under Third-Party Bike Insurance?

While third-party insurance for two-wheelers is legally essential, it comes with significant exclusions. These include:

● Damage to the insured bike due to accidents, fire, or natural calamities

● Theft or vandalism of the insured vehicle

● Personal injury to the policyholder (unless a personal accident cover is purchased separately)

● Wear and tear, mechanical breakdown, or depreciation

Due to these exclusions, riders seeking broader protection often compare it with other forms of two-wheeler insurance before making a decision.

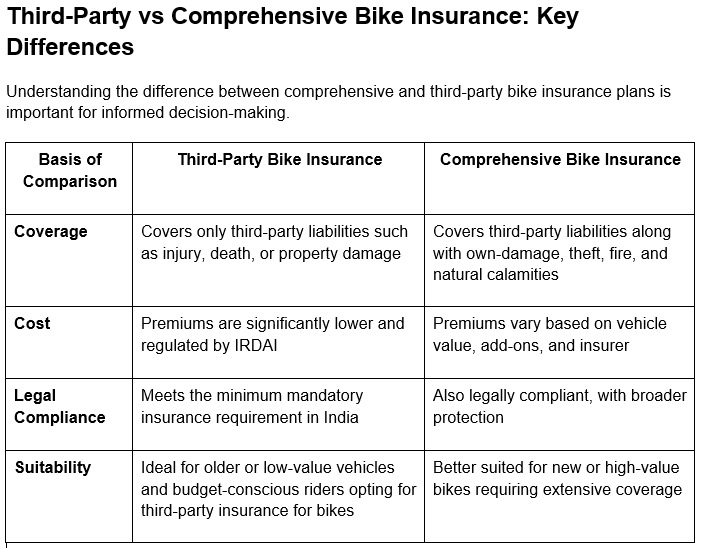

Third-Party vs Comprehensive Bike Insurance: Key Differences

Understanding the difference between comprehensive and third-party bike insurance plans is important for informed decision-making.

Benefits of Third-Party Bike Insurance

Despite limited coverage, third-party insurance for two-wheelers offers several advantages:

● Affordable Premiums: Ideal for budget-conscious riders

● Legal Compliance: Meets mandatory insurance requirements

● Simple Policy Structure: Easy to understand with fewer terms and conditions

●Quick Purchase: Available instantly for those buying third-party insurance online for two-wheelers

For riders who primarily want compliance without high costs, this form of two-wheeler insurance remains a practical choice.

Tips to Choose Third-Party Bike Insurance

Selecting the right third-party bike insurance policy involves more than just looking at price. Consider the following tips:

● Choose an IRDAI-approved insurer with a strong claims reputation

● Opt for buying third-party insurance online for two-wheelers to ensure easy digital access and convenient processes

●Ensure timely renewal to avoid penalties and policy lapses

●Consider adding a personal accident cover for enhanced protection

While it may be a basic form of bike insurance, choosing wisely ensures smoother claims and better peace of mind.

For Indian riders, third-party bike insurance remains the most affordable and legally compliant way to stay protected on the road. While it does not cover damage to the insured bike, it plays a vital role in shielding riders from financial and legal liabilities arising from third-party claims.

Whether opting for a new policy or renewing an existing one, understanding coverage, exclusions, and premiums helps riders make informed choices. Ultimately, the right insurance ensures not just compliance, but confidence every time the engine starts.